Doing Business in Japan

Taxation

Taxation for corporation

Corporate tax・Enterprise tax・Inhabitant tax

Corporation is the taxpayer of corporate tax, enterprise tax and inhabitant tax. Filing due date of final corporate tax return, enterprise tax return and inhabitant tax return is in principle within two months from the fiscal year end date. (Extension application is possible.) The effective tax rate is approximately 35.6%. (In the case of located in the Tokyo 23 wards with 100 million yen of capital)

Under the Corporate tax law, taxable income is calculated based on the accounting profit by making certain adjustments for dividends received, entertainment expenses, directors' salaries, depreciation and amortization, entertainment expenses, taxes and dues, various allowances, interest payments to foreign affiliated person, and other particular items.

A corporate reorganization tax rule is established for merger or other reorganization transactions.

Transfer pricing rule stipulates that the trading between the Japanese corporation (and Japan branch of foreign corporation) and foreign related parties must be carried out with arm's length price. This provision is in accordance with the OECD rules.

If Japanese corporation owns more than 10 percent of the equity of certain foreign subsidiaries in low tax countries, there is the application of the tax haven measures tax system.

In the system of carry-forward deduction of losses, the carry-forward period is for 10 years.

The group which consists of the parent company and all of its subsidiaries in a fully dominant relationship with its parent corporation, as one of the tax unit, can apply for the consolidated tax system that carry out tax return filing and tax payment.

Prefectures impose enterprise tax to the corporation with up to 100 million yen of capital against taxable income. Prefectures impose enterprise tax to the corporation with more than 100 million yen of capital with a pro forma standard taxation. Pro forma standard taxation is made up from income, capital and added value.

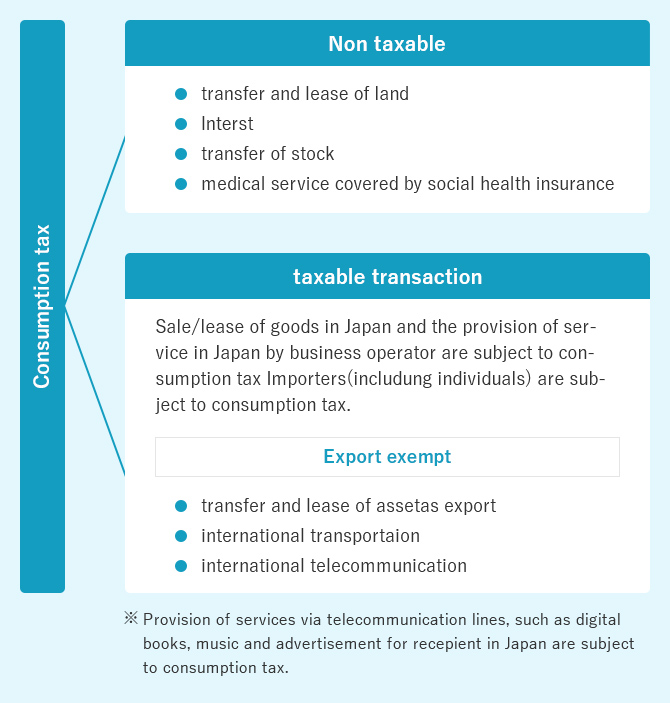

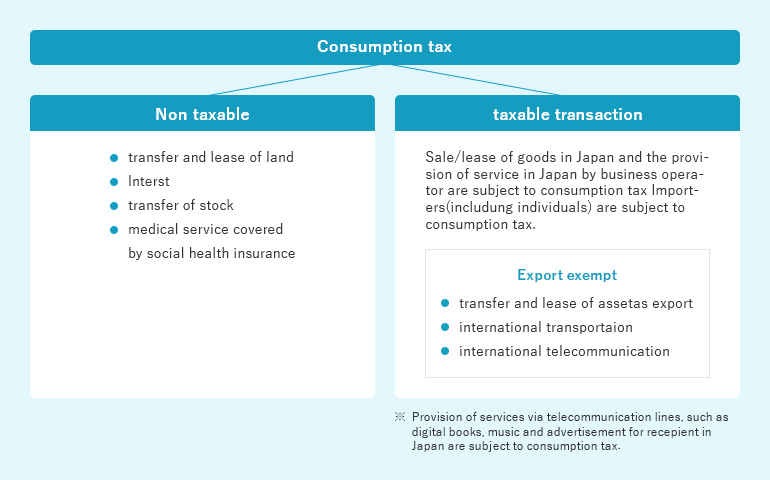

Consumption tax is a value-added tax.

Sale/lease of goods in Japan and the provision of service in Japan by business operator are subject to consumption tax. Importers (including individuals) are subject to consumption tax.

The non-taxable transactions of consumption tax are, for example, the sale or lease of land, interest, transfer of securities and a social insurance medical care.

The tax exempt transactions of consumption tax are, for example, the transfer or lease of goods as export, international transportation, and international communication.

E-commerce of the delivery of electronic books, music and advertising by foreign business operator across the border are subject to consumption tax

Tax rate of consumption tax is currently 8 percent, but it will be 10 percent from April 2017.

The consumption tax payable is calculated as received tax on taxable sales less purchase tax credit and other tax credit.

Filing due date of consumption tax return is within two months from the fiscal year end date.

Property tax

Municipal imposes a property tax for real estate and depreciable assets to its owner as a taxpayer. Tax rate of property tax is 14/1000, with respect to the fixed assets tax standard base.

Withholding income tax

Withholding tax system is that the payer of a particular income collects a predetermined income tax when paying the income and pays it to the government.

- (1) If a resident receives a payment, incomes subject to withholding income tax are as follows

- Interest (withholding tax rate 15.315%+5%), dividends (withholding tax rate 20.42% in principle), salary, public pension (withholding tax rate 5.105%or10.21%), retirement allowances and compensation charges (withholding tax rate 10.21% or 20.42%) and distribution of anonymous union (tokumei Kumiai) contracts (withholding tax rate 20.42%), etc.

- (2) Where a domestic corporation receives payment, incomes subject to withholding income tax are as follows.

- Interest (withholding tax rate 15.315%+5%), dividends (withholding tax rate 20.42% in principle), and distribution of anonymous union (tokumei Kumiai) contracts (withholding tax rate 20.42%), etc.

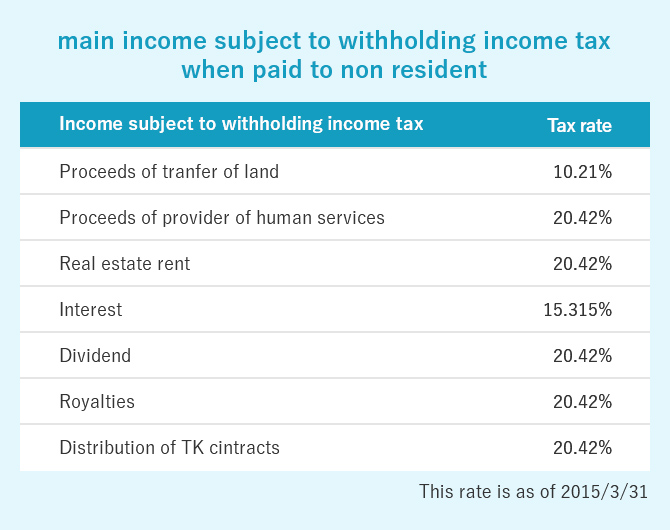

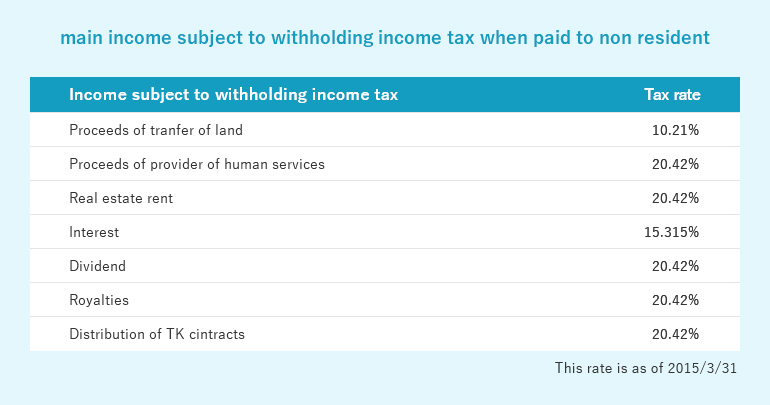

- (3) If a non-resident (non-residents and foreign corporations) receive a payment, incomes subject to withholding income tax are as follows.

- Proceeds of the transfer of land (withholding tax rate 10.21%) and, proceeds of provider of human services (withholding tax rate 20.42%) and real estate rent, etc. (withholding tax rate 20.42%), interest, etc. (withholding tax rate 15.315%) and dividend etc. (withholding tax rate 20.42%) and industrial property rights, royalties (withholding tax rate 20.42%) and distribution of anonymous union (tokumei Kumiai) contracts,(withholding tax rate 20.42%) and other certain things

- (Application of tax treaty)

- Depending on the partner countries, reducing withholding tax rates can be applied by submitting an application for the tax treaty.

- (Exemption of withholding tax)

- If the non-resident, etc. having a permanent establishment in Japan has presented an exemption certificate issued by national tax administration to the payer of income within the validity period of the certificate, the withholding income tax is exempt.