Doing Business in Japan

Social insurance

Social insurance system

Health insurance and pension insurance

This system, in preparation for an old age and time of the illness or injury, an insurance premium is contributed depending on the income, and subscribers receive the benefits of health care, pensions and lump sum in case of emergency, that achieve the stability of life as its purpose.

When the health insurance and pension insurance system broadly divided, there are two types of "health insurance and welfare

pension insurance," "national health insurance and national pension

- (1)Health insurance and welfare pension insurance

- All corporate offices and some of the individual establishments will be enforced applied office, and all regular employees of the office need to join.

Employers and employees will pay by half Insurance premiums, a certain amount in accordance with the workers of the wages. In addition, workers of less than 65 years of age or 40-year-old long-term care insurance premiums will be added.

Insurance premiums will be multiplied by the premium rate to the standard monthly remuneration.

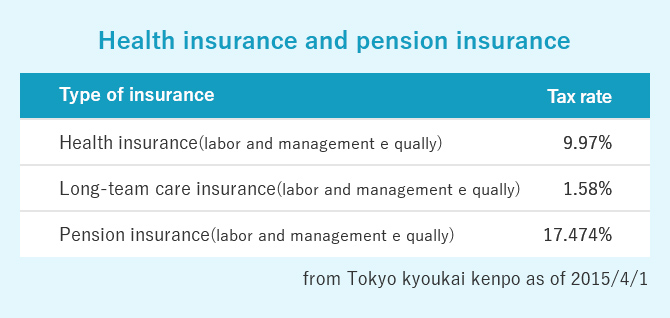

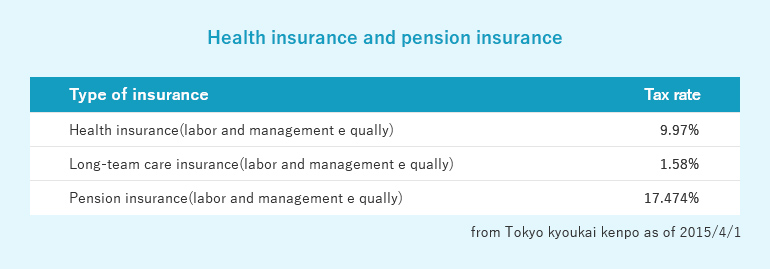

(Reference: Tokyo on April 1, 2015 Association of Health Insurance)

Health insurance rates 9.97% (labor and management equally)

Long-term care insurance premiums 1.58% (labor and management equally)

Welfare pension insurance premiums 17.474% (labor and management equally) - (2)National Health Insurance and National Pension

- This is the system to be applied for a person who does not join health insurance and welfare pension insurance.

He/she can choose insurance premiums of national health insurance to be collected as insurance premium by municipalities or to be collected as insurance tax.

National Health insurance premium (tax) is paid in the household unit, insurance premiums (tax) is calculated based on the tax residents of the household all.

Unemployment insurance

This system is intended to provide benefits in order to promote the stability of living till re-employment for the workers those are unemployed.

All corporate offices and some of the individual establishments will be enforced this system, and all regular employees of this applied establishments need to join.

However, those who are foreign public officials or have received the application of foreign unemployment compensation system will not be able to become insured.

Insurance premiums, depending on the worker's wages, will pay the rate at which labor and management were decided respectively.

(Reference: April 1, 2015 currently)

General business 13.5 / 1000 (employer 8.5 / 1000, employee 5/1000)

Agriculture, Forestry and Fisheries, brewing industry 15.5 / 1000 (employer 9.5 / 1000, employee 6/1000)

Construction industry 16.5 / 1000 (employer 10.5 / 1000,employee 6/1000)

Workers' accident compensation insurance

This system, when the workers were business on the injury, illness, or, when it was injured in an accident on the way to

work, furnishes benefit as leave compensation or to bear the medical expenses in order to achieve workers stability of life.

Employers that hire workers even one person, as corporation or private, it is required to join the workers' compensation insurance.

All workers' compensation insurance is employer burden.

This report has been prepared just for general information as of 2015.6 and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer for your advisers for specific advice.