Doing Business in Japan

Corp law

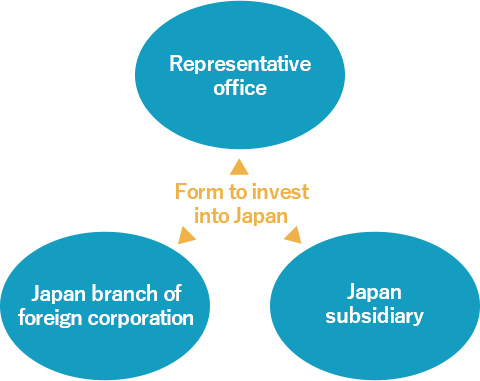

The form to invest into Japan

In the form to invest in Japan, there is a representative office, a branch or a Japanese corporation (subsidiary).

Representative office

Activities of representative office are limited to information collection and axially preparation activities. A representative office is not recognized as Permanent Establishment for Japan tax perspective and is not subject to Japanese corporate tax. However if the Representative office commits sales activities in reality, it will be recognized as Permanent Establishment for Japan tax perspective and will be subject to Japanese corporate tax.

Japan branch of a foreign corporation

The Japan branch of a foreign corporation must be registered in the Legal Affairs Bureau. The branch of a foreign corporation, as well as the Japanese corporation, is subject to corporate tax, enterprise tax and inhabitant tax. Tax rate of each tax is the same as of the Japanese corporation. The tax base of corporate tax for the Japan branch of a foreign corporation, from the start of the fiscal year since April 1, 2016, will be calculated by the attribution principle in accordance with OECD rules. Withholding income tax will not be imposed on the remittance to the head office of the surplus funds after corporate taxation.

Japanese corporation (subsidiary)

Japanese corporation must be registered in the Legal Affairs Bureau. Japanese corporation is subject to corporate tax, enterprise

tax and inhabitant tax. Withholding income of 20.42% tax will be imposed on the remittance to the shareholder as dividend.

Depending on the partner countries, reducing tax rates can be applied by submitting an application for the tax treaty.

1 person out of the representatives of the Japanese subsidiary was required a resident, and It has been abolished. However

it is recommended for administrative purposes.

Type of Japanese corporation

- The joint stock company(Kabushiki Kaisha)

- Shareholders contribute within the scope of the limited liability to incorporate the joint stock company.

Capital is contributed in units of stock which can be transferred. The joint stock company is suitable for large-scale company.

Since the provision of the minimum capital has been abolished, It is possible to establish the joint stock company by contributing one yen. - The limited liability company(Godo Kaisha)

- Shareholders contribute within the scope of the limited liability to incorporate the limited liability company as well as the joint stock company.

Capital is contributed in units of equity interest which is not suitable for transfer.

It is possible to establish the limited liability company by contributing one yen.

Ownership and management are not separated, and shareholders themselves also manage. the company. Therefore, decision-making will be quickly done. - General partnership company (Goumei Kaisha) & limited partnership company (Goushi Kaisha)

- General partnership company and limited partnership company are companies that the establishment of unlimited liability partners are required.

Capital is contributed in units of equity interest which is not suitable for transfer.

It is possible to establish the company by contributing one yen.

Capital can be contributed by the property, credit or labor.

Ownership and management are not separated, shareholders themselves also manage.

Obligations of the audit by the accounting auditor in Japan

- 1.Large companies (more than 500 million yen of capital or 20 billion yen of debt) is required the audit by accounting auditors.

- 2.Company with Committees, is required the audit by accounting auditors.

- 3.Company installing accounting audit, is required the audit by accounting auditors.